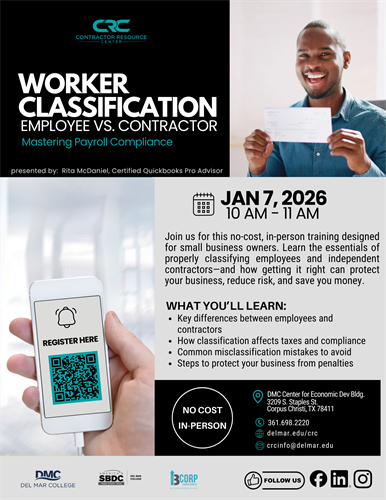

Worker Classification: Employee vs Contractor

Designed and tailored for small business owners, this in person, no-cost training explains the key differences between employees and independent contractors. Learn how proper classification affects taxes, compliance, and your bottom line—so you can avoid costly misclassification mistakes.

You’ll learn how to:

-

Distinguish between employees and independent contractors

-

Understand tax and compliance implications

-

Identify common misclassification pitfalls

-

Protect your business from unnecessary penalties

-

Make informed decisions that support long-term financial health

Date and Time

Wednesday Jan 7, 2026

10:00 AM - 11:00 AM CST

Jan. 7, 2026

10 am - 11 am

Location

DMC Center for Economic Development Bldg

3209 S. Staples St.

Corpus Christi, TX 78411

Fees/Admission

free

Contact Information

Contractor Resource Center

crcinfo@delmar.edu

Send Email

Printed courtesy of www.unitedcorpuschristi.org – Contact the United Corpus Christi Chamber of Commerce for more information.

602 N. Staples Street, Ste. 150, Corpus Christi, TX 78401 – (361) 881-1800 – info@unitedcorpuschristi.org